Who uttered the quote that is the title of this post? A prominent climate activist, perhaps? Or maybe, a progressive Democratic member of Congress?

No and no.

The quote comes from a representative of a Texas-based oil and gas production firm last week to the Federal Reserve Bank of Dallas in its March Energy Survey. Here is the full quote:

The administration’s chaos is a disaster for the commodity markets. “Drill, baby, drill” is nothing short of a myth and populist rallying cry. Tariff policy is impossible for us to predict and doesn’t have a clear goal. We want more stability.

Let’s look at some other representative comments in the survey from other oil and gas production firms:

- I have never felt more uncertainty about our business in my entire 40-plus-year career.

- The administration’s tariffs immediately increased the cost of our casing and tubing by 25 percent even though inventory costs our pipe brokers less. U.S. tubular manufacturers immediately raised their prices to reflect the anticipated tariffs on steel. The threat of $50 oil prices by the administration has caused our firm to reduce its 2025 and 2026 capital expenditures. “Drill, baby, drill” does not work with $50 per barrel oil. Rigs will get dropped, employment in the oil industry will decrease, and U.S. oil production will decline as it did during COVID-19.

- The key word to describe 2025 so far is “uncertainty” and as a public company, our investors hate uncertainty. This has led to a marked increase in the implied cost of capital of our business, with public energy stocks down significantly more than oil prices over the last two months. This uncertainty is being caused by the conflicting messages coming from the new administration. There cannot be “U.S. energy dominance” and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters). This is not “energy dominance.” The U.S. oil cost curve is in a different place than it was five years ago; $70 per barrel is the new $50 per barrel.

- The rhetoric from the current administration is not helpful. If the oil price continues to drop, we will shut in production and do quick drilling.

There are lots more where those came from.1

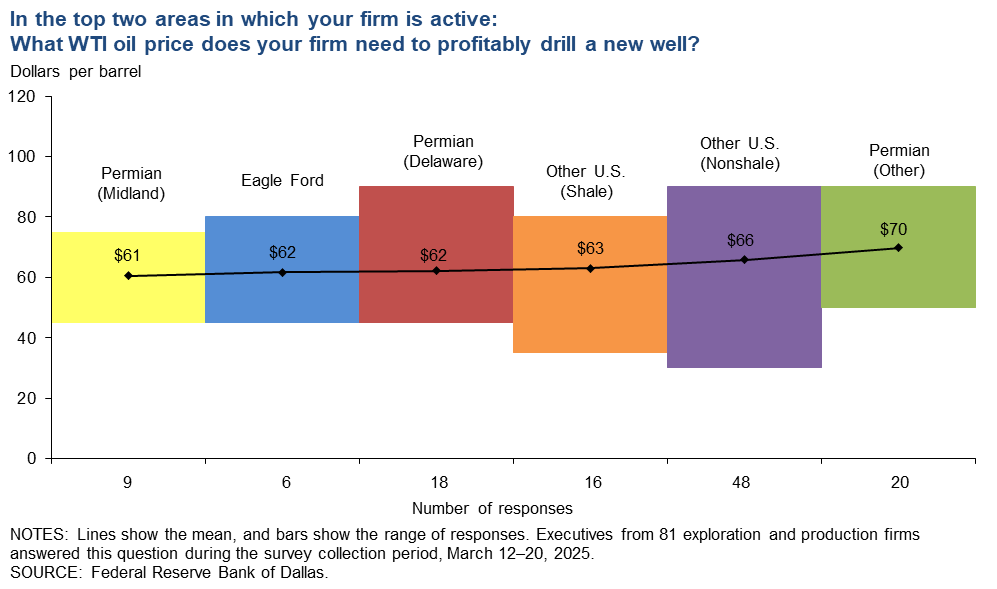

The Dallas Fed also asked firms what oil price they need to drill profitably a new well — a threshold which we might call the “drill, baby, drill” line. Their answers range from $61 to $70 per barrel of oil (WTI, mean — see the figure below), depending on their location:

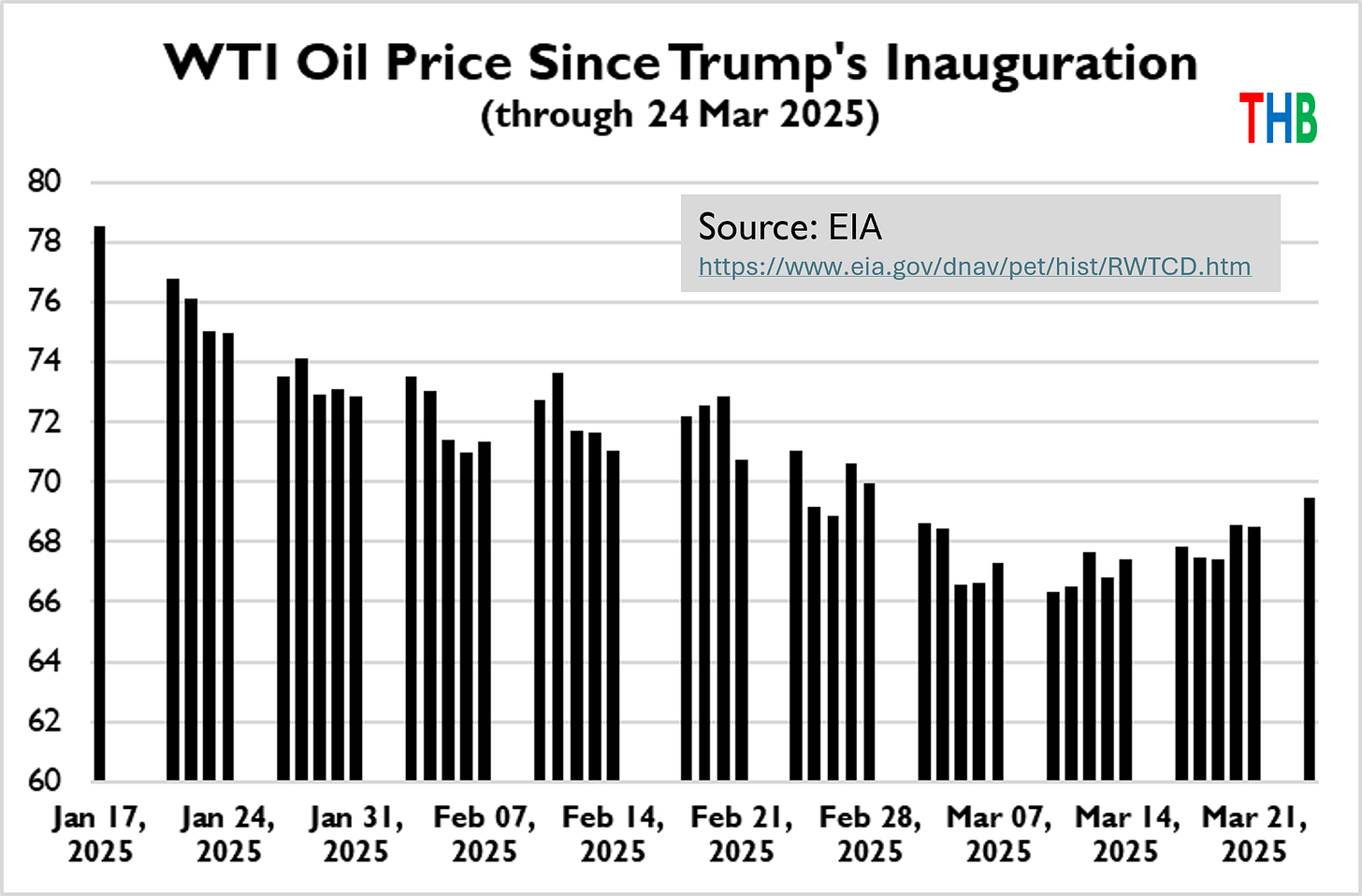

The figure below shows how the price of oil has changed since President Trump started his second term. In recent weeks the price has dipped below what a majority of operators say they require to achieve profitability though the drilling of new wells.

One comment in the Dallas Fed Survey jumped out:

For the average onshore upstream operator, the current administration versus the previous administration regulatory regime shows no real change at all. We still get our permits from the Railroad Commission in Texas, for example, not the Environmental Protection Agency. The federal regulatory regime matters if you are operating in the Gulf of Mexico or Alaska but not for the Permian, Eagle Ford, Bakken, Utica, etc. Also, asking OPEC+ to produce more hurts domestic operators.

In his remarks made at the World Economic Forum in January, just a few days after being inaugurated, President Trump said:

I’m also going to ask Saudi Arabia and OPEC to bring down the cost of oil. You got to bring it down, which, frankly, I’m surprised they didn’t do before the election. That didn’t show a lot of love by them not doing it. I was a little surprised by that. If the price came down, the Russia-Ukraine war would end immediately.

Oil prices dropped by more than $10/barrel in the weeks after President Trump made those remarks (after OPEC+ acquiesced to some degree) — and, as we all know, the war did not end. More generally, a coalition of countries have tried to implement a price cap on the prices that Russia can receive for its oil with limited success (see also this fascinating article on “dark shipping” by my AEI colleague, Jesús Fernández-Villaverde and colleagues).2

In complex and contested policy issues, a US president faces competing incentives and objectives. In the case of domestic oil and gas production, to motivate increased production requires oil and natural gas prices that makes economic sense to those who are doing the drilling. The promise of lower prices for gasoline and gas for consumers works in the opposite direction. Add in the overlay of using fossil fuel prices as a means of countering Russia’s invasion of Ukraine, and things get much more complicated.

Energy policy is complex, with outcomes shaped in the near-term much more by market economics than by political promises. Politicians, of course, heroically try to work all sorts of magical illusions, but they have yet to figure out how to make prices go up and down at the same time.

This complexity is why policy matters.

The U.S. needs a well-considered, coherent energy policy that recognizes the trade-offs necessary to achieve multiple objectives that are often not in concert.

A “myth and populist rallying cry” is no substitute.

This article originally appeared on Roger’s Substack, The Honest Broker. If you enjoyed this piece, please consider subscribing here.

1 Oil and gas prducers also expressed considerable unhappiness with the Biden Administration in the Dallas Fed’s March 2024 Survey.

2 Actions that decrease oil prices to a level that would hurt Russia on the oil market (dark or not) would seem to require governments to subsidize fossil fuel production to lower prices that would not be economic in market terms — This is a hypothesis, not a rigorous conclusion, and I’d welcome experts in oil markets to provide input here.