Every fall since 2020 I have been teaching energy economics in Northwestern University’s Master of Science in Energy and Sustainability (MSES) program. I team teach with my friend Mark Witte, and my part of the course is backloaded—natural monopoly theory and regulation in theory and in history, new generation technology invention and adoption, wholesale power markets, digitalization and distributed energy resources and the implications of innovation for enabling us to create a cleaner and prosperous energy future. Our class focuses on fundamental economics concepts, applied to the dynamics of regulation and innovation.

Historical Origins

The story starts, of course, in the late 19th century and the commercialization into electric lighting service of dramatic new inventions: Thomas Edison’s integrated system of boiler, generator, direct-current wires, and lighting fixtures (and light bulbs). Edison famously employed the eccentric genius Nikola Tesla, who was furiously inventing new devices and new approaches to electricity transportation and use. Tesla invented transformers that enabled alternating current, with current flowing through coiled wires as multiple out-of-phases sine waves rather than the direct current that was Edison’s design. AC would allow generation to be built in larger scale remotely than it could be in the city confines that Edison’s DC design required. But as part of Edison’s workshop, a cog in his machine, Tesla and his AC ideas had no future, so he took his patents and licensed them to Pittsburgh entrepreneur George Westinghouse.

Tesla and Westinghouse beat Edison to win the contract to electrify the Columbian Exposition in Chicago in 1893, and in 1895 they began a collaboration with Canadian engineers to build hydroelectric generation at Niagara Falls and use AC transmission to transport this gargantuan amount of electricity to Toronto, Buffalo, Rochester, and eventually population centers further afield as the technology improved (US side)(Canada side). In S-curve, technology life cycle terms, AC networks were in their infancy in these two projects, and would those projects and others would lead to improvements and refinements in their designs and capabilities. More than any other invention, AC transmission enabled the electricity industry to grow to an unprecedented scale, both in terms of electrification in general and in terms of the ability to build larger and larger power plants to create and reap the benefits of economies of scale in both generation and transmission.

Competition Among Imperfect Substitute Technologies

I’m getting ahead of the story, which at its origin is a story about lighting. Providing and selling a mass-market electric lighting system was Edison’s goal, and lighting was the dominant use case for electricity; streetcar and later subway electrification also started in the 1880s.

Think about the startup market analysis you’d perform if you were Edison going in to J.P. Morgan, his main financial backer. What are the other lighting technologies? Beeswax candles had been the dominant technology for many centuries, and by the mid-19th century they had become inexpensive, but the light output was low and the light quality was poor if you wanted to read or get any work done in a low-light setting or at night. The early 19th century saw the invention and rapid move from infancy to mass adoption of the whale oil lamp, which provided brighter and higher quality light that lasted longer. The smell was not great. But whale oil proved a strong substitute for candles—different technologies with different portfolios of features, pro and con. The demand for whale oil lamps came from homes and also from growing manufacturing in urban areas. Whale oil lamps were so popular that whaling increased as the demand for whale oil shifted out. Fishing whales close to extinction and the “Deadly Catch” types of whaling ventures it took to harvest these remaining whales meant that whale oil prices skyrocketed.

Time to look for a substitute. By this time in the 1850s, entrepreneurs in a small town in Western Pennsylvania called Titusville had discovered large petroleum oil deposits and developed technologies for extracting the oil and refining it into kerosene, based on initial work in the 1840s by Canadian A.P. Gesner. Daniel Yergin’s book The Prize recounts the story of the transformational effects of kerosene due to improvements in its refining and in the complementary technology, the kerosene lamp (and if you haven’t read it yet, run-don’t-walk to order it immediately from your favorite bookseller or library, you will not regret it; Dwarkesh Patel’s notes on The Prize part 1 will whet your appetite).

[Note: In cities gas lighting was also a growing option, which I’ll abstract from here for brevity.]

Game changer. Kerosene burned cleaner than either candles or whale oil, with less smoke and less smell, lasted longer, and was substantially cheaper than whale oil had become. With the discovery of oil in Western Pennsylvania, kerosene quickly became plentiful. It was cheap, and it was clean compared to the more mature technologies. As Ben and David said in their Acquired podcast episode on Standard Oil in 2021 (episode 1 of 2), the key word was plentiful. Think about what this plenitude enables: inexpensive nighttime lighting democratizes residential lighting and makes working conditions in factories more pleasant. Kerosene lighting raised living standards and productivity because it was cleaner, cheaper, and easier to use than alternative lighting technologies.

Notice the comparison there, the “compared to what?” at the core of every economic question. Yes, kerosene is a fossil fuel and thus has criteria pollutant and greenhouse gas emissions, but it yields more and better quality light per unit of energy than its competitors, which themselves also have emissions and other environmental costs.

There are no solutions, only tradeoffs. These different lighting technologies had different sets of features, different pros and cons, so they were imperfect substitutes for each other. Over time through innovation new technologies with different sets of features and failings compete with legacy technologies. Consumers decide what failings they are willing to endure to get the value of the features.

This Economic History Helps Us Think About Natural Gas

Having taught this material several times, the parallels between kerosene and natural gas struck me anew this week from listening to the Acquired podcast episode on Standard Oil. Then while I was musing on the analogy, Josh Smith wrote about natural gas as the neglected middle child of energy supply and of recent environmental progress. The role of gas as a decarbonizing factor is underappreciated. Check out the graphs that Josh posted, they are stunning, and they support the comparison with kerosene—natural gas is cleaner, cheaper, and easier to use than its fossil fuel competitors.

But it’s also a valuable complement to renewable generation. As noted in a 2015 report from the National Renewable Energy Laboratory,

increasing variable RE integration more generally necessitates flexible resources, such as generation from fast response NG turbines. Together, NG and RE can help contribute to a low-carbon, resilient, and reliable electrical grid by diversifying the electricity mix and hedging risk associated with market and policy uncertainties. Factors driving the transition toward synergistic portfolios of NG and RE include price stability, technological advances, policy incentives, regulatory changes, flattening demand, and innovative business models and financing mechanisms. (emphasis original) (NREL 2015, p. v)

Like kerosene, natural gas is plentiful, and more so since the shale revolution starting in 2008. In addition to having roughly half the carbon footprint of coal generation and thus being decarbonizing when it substitutes for coal in the portfolio, natural gas generation is responsive and a contributor to flexibility in power systems. It makes grid operators more confident that they can increase wind and solar on the system while maintaining reliability (although note that Winter Storm Uri in 2021 revealed how devastating the electric-gas interdependence can be when the entire gas supply system freezes, so gas is not a silver bullet).

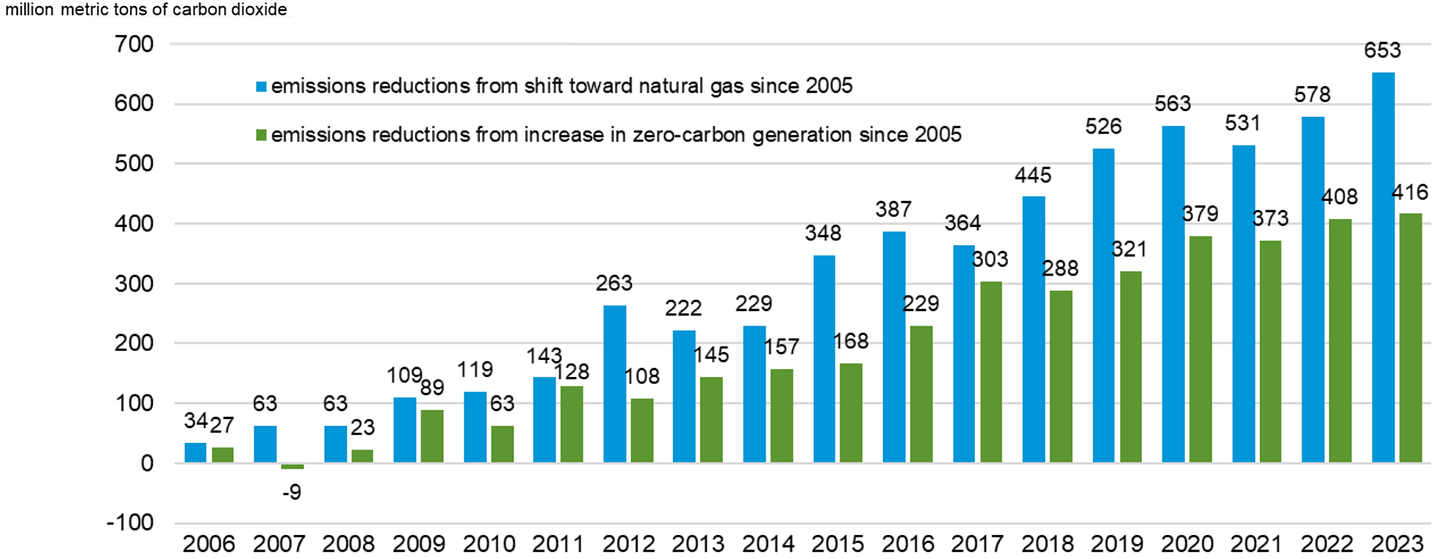

Some of the most striking data illustrating these points come from an EIA analysis that they perform periodically, most recently with data through 2023:

Source: EIA (2024)

The green bars are estimates of the amount of GHG emissions reductions arising from increased renewables in the generation portfolio, renewables substituting for fossil fuels. The blue bars are estimates of the GHG emissions arising from increased natural gas in the generation portfolio, natural gas substituting for coal and serving as dispatchable backup for renewables.

Two dominant points stand out. First is the timing: natural gas has been in the fuel mix for decades, increased first in the 1990s “dash to gas” with the invention of the combined cycle gas turbine and the development of organized wholesale power markets. It is a growing share of the generation portfolio after 2008, when the shale revolution made gas even more plentiful.

The second is the magnitude: the blue bars exceed the green bars, showing how gas-coal substitution due to economic changes in relative price has had a greater decarbonizing effect in aggregate than increased renewables has. This is why Josh is right when he calls out the contribution of gas to environmental progress, in addition to its contribution to economic progress.

Of course there are still costs and issues to deal with, like methane leakage at wells (and there are cool new technologies for identifying them with greater precision). But the story of kerosene and the story of natural gas have parallels in themes of economic and environmental alignment, and of abundant cleaner energy contributing to both economic and environmental progress.

This article was originally published on Lynne’s Substack, Knowledge Problem. If you enjoyed this piece, please consider subscribing here.