Today I’m traveling to the 2024 Institute for Regulatory Law & Economics Workshop for Regulators. The 2024 IRLE Workshop marks not only the 18th annual gathering of regulators and scholars, but also the 20th anniversary of IRLE’s founding. Over the past two decades, this workshop has evolved into a valued educational and translational research resource for regulators navigating the complex interplay of technological, economic, and policy changes that define today’s energy landscape. The importance of the workshop stems from the rapidly changing world of electricity regulation, where regulatory institutions designed for 20th century technologies are tested continuously by innovation.

The need for sound, economically-informed, forward-looking regulatory decision-making has never been more urgent.

At the heart of IRLE’s mission is its commitment to offering an intellectual framework that empowers regulators to understand and address the challenges of technological dynamism. Technological dynamism in the form of the combined-cycle gas turbine generator was one driver of regulatory restructuring and the formation of organized wholesale power markets in the 1990s. When we founded IRLE in 2004, the electricity sector was already beginning to feel more tremors of change.

First, advances in digital technologies enabled smart grid and grid modernization, and then the rise of renewable energy and growing policy demands for decarbonization have signaled new policy objectives and new opportunities for new market models and new industries. How can regulatory institutions adapt to these changing conditions and make sure that they aren’t impediments to innovation? Today, those forces are even more pronounced, and regulators are tasked with the difficult job of adapting institutions and practices in real-time to keep pace.

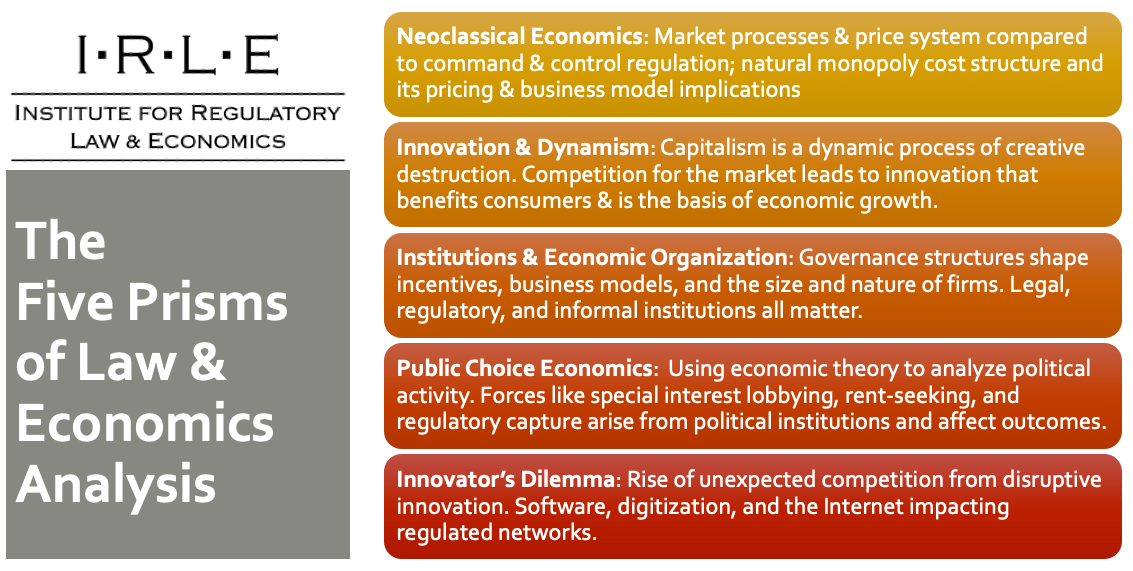

The workshop provides regulators with the tools and knowledge to make economically-informed decisions in this complex environment. Our Five Prisms of Law & Economics Analysis framework distills decades of regulatory practice and academic research into a cohesive framework that equips regulators to handle these multifaceted challenges:

- Neoclassical Economics: This prism underscores the importance of understanding market processes, how markets coordinate in complex systems, the nature of competition, and the tradeoffs regulators must weigh. Microeconomic price theory and market process economics, grounded in basic market (supply/demand) models, provide the intellectual foundation for both the theory of economic regulation and critiques of that theory and its application in public utility regulation. Neoclassical economics enables us to evaluate and weigh tradeoffs when making decisions and to understand why and how markets enable people to create value through mutually-beneficial exchange. It also helps us understand the cost structure underlying the vertically-integrated natural monopoly model. The traditional natural monopoly model, rooted in neoclassical economics, helps explain the structure of many utility markets but also reveals the limitations of static thinking in an era of rapid technological innovation.

- Innovation & Dynamism: Much of the neoclassical economics that’s embedded in utility regulation through the natural monopoly model is very static, and doesn’t take into account the fact that societies and economies are constantly changing. Indeed, over the past 40 years digitization has accelerated change. The Schumpeterian lens of creative destruction is essential for understanding how technological advances disrupt the status quo. These changes can create new products and services, new sources of inputs into production, and new methods of organizing production. Regulators must grapple with the effects of these disruptions on both consumers and utility business models, recognizing that static regulatory models may not adequately capture the pace of change.

- Institutional & Organizational Economics: Economic activity always occurs within an institutional context. Institutions are the “rules” that shape our incentives and influence our decisions and behavior. These rules can be long-term cultural conventions, social norms, or formal laws and regulations. Another aspect of the institutional context is the organization of production into firms, or through contracts. The traditional vertical integration of electric utilities is an example of organizing the electricity supply chain into a single firm (driven largely by the cost structure analyzed using neoclassical economics), and technological changes, from the combined-cycle gas turbine in the 1980s to solar PV and digital consumer devices today, create economic pressures to unbundle that vertically-integrated structure. This prism enables us to analyze effects of the economic, technological, and social change on organizational structure and regulation. Factors like transaction costs change when technologies change (especially digital technologies), and transaction costs are an important determinant of business models and when to transact through markets rather than organizing production internally within a firm. This prism enables regulators to analyze how technological and economic changes—like the shift from vertically integrated monopolies to more disaggregated, competitive structures—create pressures for institutional reform.

- Public Choice Economics: Regulation is not just an economic or technical endeavor; it’s a political one. Public choice theory helps regulators see how political incentives shape decision-making and regulatory outcomes. Public choice economics uses economic theory frameworks and tools to analyze political decision-making and the choices people make in their roles as political actors: voters, elected representatives, regulators, agency leaders, lobbyists. The public choice economics prism provides an analytical framework for understanding economic-political interactions and how technological change affects those interactions, as well as how special interest lobbying, rent-seeking, and regulatory capture can influence the direction and pace of technological change.

- The Innovator’s Dilemma: Disruptive technologies pose a significant challenge for incumbent firms and regulators alike. Network industries like electricity and communications have common technological and economic characteristics, including network effects and economies of scale and scope. This prism uses Clayton Christensen’s work on “the innovator’s dilemma” to examine how technological revolutions, from microgrids to AI-driven grid management, challenge existing regulatory frameworks. Why do technology startups overtake established incumbents? How do software, digitization, and the internet affect existing regulated networks? Another important element of this prism is a focus on the role of network architecture, and how network architecture can influence innovation and new technology adoption (including, for example, distributed energy resource interconnection). For regulators, the key is not only recognizing disruption but anticipating as much as possible how it will/should reshape network architectures and regulatory norms.

This workshop is valuable because it doesn’t just offer theoretical insights—it fosters dialogue and practical learning among regulators. We bring together scholars and regulators to examine real-world case studies and develop strategies for adapting regulatory practices to new technological realities. Whether addressing the implications of distributed energy resources, the challenges of integrating renewable energy, the uncertainties of increasing electricity demand due to AI, or the intricacies of modernizing grid architecture, the IRLE workshop equips regulators with the intellectual tools they need to craft sound, forward-thinking policies.

One distinctive highlight of the IRLE curriculum is the use of experiential, experimental economics as part of our pedagogy. The experiments put the attendees in the roles of market actors, making output, pricing and quality decisions within varying regulatory and market institutions, using the experimental economics paradigm pioneered by Nobel laureate Vernon Smith. IRLE’s experimental economics teaching focuses on the unique nature of electricity markets and how changes in the institutional structure of those markets can change incentives and outcomes.

Experimental economics can provide valuable insights for regulators by allowing them to observe and analyze the effects of different market structures and rules on incentives, behavior, and outcomes in a controlled laboratory environment. By simulating various market scenarios and institutional arrangements, researchers can identify potential issues, inefficiencies, or unintended consequences that may arise from specific institutional frameworks before implementing them in real-world markets. This research can help regulators understand how different market mechanisms, such as auction formats, pricing rules, or capacity market designs, influence factors like competition, decarbonization, investment incentives, resource adequacy, and market power. Experiments can also shed light on the effects of regulatory interventions, such as price caps or subsidies, on market participants’ strategies and overall market performance. By leveraging the findings from these controlled experiments, regulators can make more informed decisions when designing or modifying electricity regulation and market structures.

As we celebrate 20 years of IRLE, we focus squarely on the future. The energy transition is accelerating, and with it comes the urgent need for resilient regulation that can absorb change without losing sight of the core principles of fairness, efficiency, affordability, and reliability. Our annual workshop stands as a testament to the importance of continuous learning and adaptation in this dynamic, evolving context. We are proud of what IRLE has accomplished and look forward to continuing this essential work in the years to come.

This post originally appeared on Lynne’s Substack, Knowledge Problem. If you enjoyed this post, please consider subscribing here.